Backtesting

Before taking any strategy live, it’s crucial to understand how it would have performed in past market conditions.

This is where backtesting comes in.

Our platform offers a powerful backtesting engine that simulates your strategy’s performance on historical data—helping you validate logic, assess risk, and optimize parameters before risking real capital.

Why Backtesting Matters

With backtesting, you can:

- Analyze win rate, average return, and drawdowns

- Compare results across different instruments and timeframes

- Iterate and improve strategy logic based on insights

Whether you're building with no-code blocks or writing Python code, every strategy can be backtested with just a few clicks.

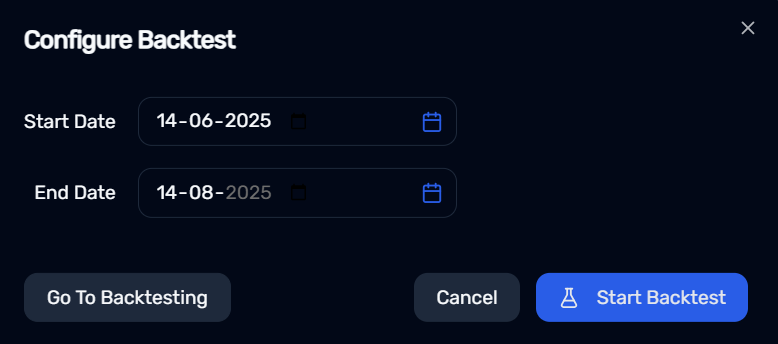

Running a Backtest

Once your strategy is saved, you can easily backtest it to evaluate historical performance.

To begin:

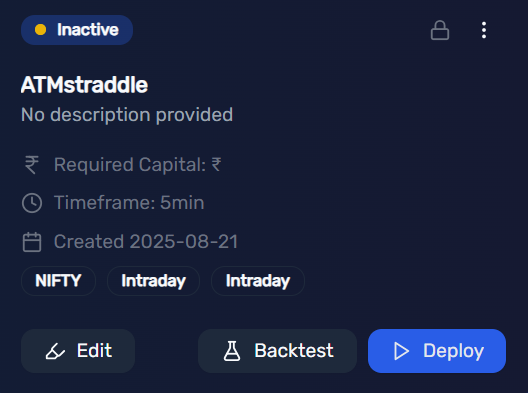

- Navigate to My Strategies under the Strategies menu.

- Locate your strategy and click the Backtest button.

- Choose your desired start date and end date for the backtest period.

- Click Start Backtest.

The platform will process your request, and results will be available within a few minutes under the Backtest tab in the Strategies section.

Review Backtest Results

This feature allows you to review:

- Entry and exit points

- Strategy-level performance metrics

- P&L trends over time

- Execution logic accuracy

Backtesting helps you validate your strategy logic, fine-tune parameters, and build confidence before going live.

Detailed Analysis

Once your backtest is complete, click on View Backtest to access the full analysis.

This section provides a detailed breakdown of your strategy’s performance, including key metrics, charts, and trade summaries.

For a deeper dive, navigate to the Trades tab (next to Overview). Here, you can review:

- Individual trade logs

- Entry and exit timestamps

- Instrument details

- P&L for each trade

This comprehensive view helps you assess how well your strategy performed and identify areas for refinement before going live.